Doonan, Graves & Longoria, LLC

U.S. District Court Rejects Mortgagor’s Attempt to Expand the

Scope of the Predatory Home Loan Practices Act

- Brian C. Linehan, Esq.

May 2024

U.S. District Court Rejects Mortgagor’s Attempt to Expand the

Scope of the Predatory Home Loan Practices Act

On March 12, 2024, the U.S. District Court for the District of Massachusetts issued its decision in Taslis v. U.S. Bank NA, Tr., --- F.Supp.3d ---, 2024 WL 1069875 (D.Mass. Mar. 12, 2024), in which the Plaintiff-Mortgagor sought a preliminary injunction to avoid the Defendant’s foreclosure sale of her rental property based upon claims under the Massachusetts Predatory Home Loan Practices Act, G.L. c. 183C (“PHLPA”). The Plaintiff claims were premised upon alleged predatory practices in the origination and subsequent modification of the mortgage loan at issue. The PHPLA is a consumer protection statute that narrowly applies to mortgage loans that meet the statutory definition of the term “high cost home mortgage loan.” Id., at *3. Under the statute, a “high cost home mortgage loan” is a

consumer credit transaction that is secured by the borrower’s principal dwelling, other than a reverse mortgage transaction, a home mortgage loan that meets 1 of the following conditions:

(i) the annual percentage rate at consummation will exceed by more than 8 percentage points for first-lien loans, or by more than 9 percentage points for subordinate-lien loans, the yield on United States Treasury securities having comparable periods of maturity to the loan maturity as of the fifteenth day of the month immediately preceding the month in which the application for the extension of credit is received by the lender; and when calculating the annual percentage rate for adjustable rate loans, the lender shall use the interest rate that would be effective once the introductory rate has expired.

(ii) Excluding either a conventional prepayment penalty or up to 2 bona fide discount points, the total points and fees exceed the greater of 5 per cent of the total loan amount of $400; the $400 figure shall be adjusted annually by the commissioner of banks on January 1 by the annual percentage change in the Consumer Price Index that was reported on the preceding June1.

Id. (quoting G.L. c. 183C, § 2).

Because the mortgage loan at issue was originated in 2006 and modified in 2011, the Plaintiff advanced her claims under the PHLPA in an attempt to receive the benefit of the statute’s exception to the statute of limitations that typically applies to claims of predatory lending and claims under G.L. c. 93A. Id. at *5. Although the mortgage loan did not meet the statutory definition of a “high-cost home mortgage loan,” the Plaintiff argued that she was entitled to relief under the PHLPA as a result of dicta set forth in the Massachusetts Supreme Judicial Court’s (“SJC”) decisions in Commonwealth v. Fremont Investment & Loan, 452 Mass. 733, 897 N.E.2d 548 (2008) and HSBC Bank USA, N.A. v. Morris, 490 Mass. 322, 190 N.E.3d 485 (2022). See Taslis, 2024 WL 1069875, at *5.

Fremont did not involve a claim under the PHLPA, however, the SJC held that the PHLPA could serve as a foundation for demonstrating unfairness in the defendant’s loan origination practices. Fremont, 452 Mass. at 748-749. Nevertheless, as the U.S. District Court recognized, Fremont did not expand the scope of the PHLPA to allow claims that involve mortgage loans that do not meet the statutory definition of a “high cost home mortgage loan.” See id.; Taslis, 2024 WL 1069875, at *5. Rather, the SJC determined that the requirements of the PHLPA constitute an established concept of unfairness for the purposes of demonstrating a claim under G.L. c. 93A. See Fremont, 452 Mass. at 748-749. Nevertheless, to benefit from the statutory exception to the statute of limitations provided under the PHLPA, the mortgage loan at issue must fall within the statutory definition of the term “high-cost home mortgage loan.” Taslis, 2024 WL 1069875, at *5.

Because the mortgage loan at issue did not constitute a high cost home mortgage loan under the PHLPA, the U.S. District Court determined that the Plaintiff could not demonstrate a likelihood of success on the merits of her claims. As a result, the Court denied the Plaintiff’s motion for preliminary injunction.

If you would like to learn more about this decision or our Default Services in Maine, Massachusetts and New Hampshire please reach out and contact our Business Development Lead, Beth Stillings, to set up time to discuss. bs@dgandl.com

"Taslis relies on two decisions by the Massachusetts Supreme Judicial Court . . ., which she argues supprt the conclusion that a mortgage loan does not need to strictly satisfy the PHLPA's statutory criteria to be considered a high-cost mortgage loan. Taslis argues that the analysis of whether a loan qualifies as a high-cost home mortgage loan should instead center on the concept of unfairness and a lender's recognition of a borrower's inability to repay. However, neither of the cited cases supports such a conclusion."

Doonan, Graves & Longoria, LLC

Massachusetts Law Applies to Massachusetts Foreclosures

- Brian C. Linehan, Esq.

April 2024

Enforcing Choice of Law Provision would

Contravene Massachusetts Foreclosure Policy

On March 6, 2024, the U.S. District Court for the District of Massachusetts issued its decision in Pale Horse Realty, LLC v. Bezio, --- F.Supp.3d ---, 2024 WL 967593 (D.Mass. Mar. 6, 2024), which involved a claim to foreclose a Mortgage that included a choice of law provision requiring that the contract be governed by Ohio law. The choice of law provision also indicated that Ohio law should apply to the Mortgage without regard to conflict of law principles. The Defendants argued that the Plaintiff’s foreclosure claim was time-barred as such claims are subject to a six-year statute of limitations under Ohio law.

The Court recognized that, although parties are typically free to choose which state’s laws will govern their contractual rights and obligations, there are two important exceptions to this general rule. See id. at *3. First, a choice of law provision should not be enforced “if the chosen state has no substantial relationship to the parties or the transaction and there is no other reasonable basis for the parties’ choice.” Id., citing Hodas v. Morin, 442 Mass. 544, 550, 814 N.E.2d 320 (2004). Courts should also decline to enforce a choice of law provision if “application of the law of the chosen state would be contrary to a fundamental policy of a state which has a materially greater interest than the chosen state.” Id., citing Hodas, 442 Mass. at 550, 814 N.E.2d 320. The Court determined that the Plaintiff’s claims fell within both of the exceptions to the general rule. Id.

Applying the first exception, the Court determined that, although National City Bank, the originating lender, is based in Ohio, the Mortgage had subsequently been assigned to Pale Horse Realty, LLC, which is a Delaware limited liability company with its headquarters located in New York. See id. Further, the Defendants are residents of Massachusetts, which is also where property secured by the Mortgage is located. See id. Thus, the Court determined that the State of Ohio has no substantial relationship to the parties or the mortgage loan transaction. See id.

The Court determined that the second exception to the general rule regarding choice of law provisions also applies because the Mortgage at issue allows for foreclosure by exercise of the statutory power of sale. See id. In contrast, Ohio law does not permit a mortgagee to foreclose a mortgage by exercise of the statutory power of sale without judicial oversight. See id. Thus, applying Ohio law would run “contrary to a fundamental foreclosure policy of Massachusetts.” Id. The Court further acknowledged that applying this standard to foreclosures is also consistent with the Restatement (Second) of Conflict of Laws, which provides that mortgages and the foreclosure of mortgages are governed by the local law of the situs. See id., citing Restatement (Second) of Conflict of Laws §§ 228, 229 (1971).

Because Massachusetts law applies, the Court determined that the statute of limitations did not expire with respect to the Plaintiff’s foreclosure claim until five years after the maturity date stated in the Mortgage. See id., at *4. The Mortgage at issue does not mature until July 9, 2037, and, as a result, the Court rejected the Defendants’ argument that the Plaintiff’s claim is time-barred. See id.

If you would like to learn more about this decision or our Default Services in Maine, Massachusetts and New Hampshire please reach out and contact our Business Development Lead, Beth Stillings, to set up time to discuss. bs@dgandl.com

Applying Ohio law would run “contrary to a fundamental foreclosure policy of Massachusetts [and]. . . that applying this standard to foreclosures is also consistent with the Restatement (Second) of Conflict of Laws, which provides that mortgages and the foreclosure of mortgages are governed by the local law of the situs.”

Doonan, Graves & Longoria, LLC

The End to "Free House" Decisions in Maine

Update: Moulton Math Clarified

- Reneau J. Longoria, Esq.

March 2024

The End to "Free House" Decisions in Maine

Update: Moulton Math Clarified

The Maine Law Court overturned the “one and done” foreclosure rule in Maine, which, since 2017, has resulted in debtors receiving “free houses” through frequently irrelevant discrepancies in legitimate demand letters provided to debtors under Title 14 § 6111. The Law Court specifically found that such a rule, which received its legitimacy under the Deschaine/Pushard cases, created an anomaly only for Maine cases so that if there was a technical defect in a foreclosure notice, no further action could be taken to enforce the note or mortgage. Maine has now joined the rest of America in declaring that a typo in a demand letter will not result in the debtor receiving a free house. Maine waited with anticipation for the decisions in Finch v. U.S. Bank, 2024 ME 2 (2024 WL 118478) and J.P. Morgan Mortgage Acquisition Corp. v. Camille J. Moulton (2024 ME 13), however as with many things, the controversy is in the details and it quickly became apparent that the “Math” for the re-demand, the formula outlined in Finch differed from that in Moulton. A Motion to clarify Moulton was filed in early March and the Law Court addressed and responded quickly that it was the Finch formula that controlled. The Court specifically revised Paragraph 12 of the opinion as follows:

[¶12] In Finch v. U.S. Bank, N.A., we held that where a lender has not complied with the prerequisites to acceleration under Section 6111, a court cannot conclude that initiation of a foreclosure action nevertheless accelerates the note balance. 2024 ME 2, ¶ 6, --- A.3d ---. Therefore, when a court enters summary judgment against a lender or dismisses the lender’s foreclosure claim due to a deficient notice of the right to cure under Section 6111, the effect of the judgment or dismissal of the claim is to preclude any future claim for the unaccelerated balance due on the note as of the date of the judgment (unless the lender has asserted a separate claim for the unaccelerated balance due). Id. ¶¶ 51-52. It does not preclude the lender from bringing a future foreclosure claim based on a future default, nor does it discharge the entire mortgage or effect a transfer of title. Id. ¶ 52.

Any hesitation to dismiss and re-demand following these additional guideposts was addressed in a footnote commenting that while not appealed here, a lender’s Motion to Dismiss without prejudice to re-demand should be granted. The Law Court noted, “J.P. Morgan did not raise, and we therefore do not address, any issue regarding the court’s denial of its motion to dismiss. Nonetheless, we note that such dismissal would be appropriate, especially in light of Finch, 2024 ME 2, --- A.3d ---.”

With this guidance we go forward and carefully assess and reassess, especially matters pending during the Covid years to confirm the foreclosure is brought on a compliant demand.

If you would like to learn more about this decision or our Default Services in Maine, Massachusetts and New Hampshire please reach out and contact our Business Development Lead, Beth Stillings, to set up time to discuss. bs@dgandl.com

Moulton Math Revised by Maine Law Court

To read the updated decision and order, please click the links below.

Doonan, Graves & Longoria, LLC

The End to "Free House" Decisions in Maine

- Reneau J. Longoria, Esq.

January 2024

The End to "Free House" Decisions in Maine

This week the Maine Law Court overturned the “one and done” foreclosure rule in Maine which had resulted in debtors receiving “free houses” since 2017 through miniscule, and frequently irrelevant, discrepancies in legitimate demand letters provided to debtors under Title 14 § 6111. The Law Court specifically found that such a rule, (which received its legitimacy under the Deschaine/Pushard cases) created an anomaly only for Maine cases so that if there was a technical defect in a foreclosure notice, no further action could be taken to enforce the note or mortgage. Maine has now joined the rest of America in declaring that a typo in a demand letter will not result in the debtor receiving a free house. Maine has waited with anticipation for the decisions in Finch v. U.S. Bank, 2024 ME 2 and J.P. Morgan Mortgage Acquisition Corp. v. Camille J. Moulton, Oxf-21-412 (Argued Nov. 1, 2022, and in which Doonan, Graves & Longoria, LLC filed an amicus brief asking for the Rule of Pushard to be reversed)The Law Court, as it said itself, is moving on from “casino-by-court”.

Since Doonan, Graves & Longoria has waged these battles for decades, some perspective is helpful on how far we have come on this long journey. At one point Maine stood alone, in a number of respects, which seriously chilled lending, impeded servicing, and hamstrung loan sales. Maine had a singular perspective on evidence, which required that ALL servicers that had touched a loan must testify as to the related business records and Maine alone required non-existent probate estates to be joined as necessary parties. Maine defense counsel even argued that law firms could not send acceleration notices under the Maine Statute. We fought these rules in both the State and Federal Courts and through the Jones, Needham and Keniston decisions confirmed basic business records exceptions to the hearsay rule, agency relationships apply to foreclosure matters, and fictional parties are not required to be named in foreclosure cases.

Finch, in essence, adopts the argument we made in our Amicus that the demand letter, in and of itself, does not accelerate the entire loan. There are a number of points that are very relevant in this 67-page decision that represents a sea-change in Maine Law. The Law Court suggests that sanctions may be used more frequently by trial courts for abuses in the foreclosure context. Additionally, there is clearly a risk that if a demand is defective any interest that accrues from the original default to the finding that the demand is defective is not collectable.

Today we learned that Jimmy Stewart was right, you can succeed by fighting for what seems to be a lost cause. We will continue to fight for our clients. We will review pending litigation and outline strategic recommendations for all impacted files.

If you would like to learn more about this decision or our Default Services in Maine, Massachusetts and New Hampshire please reach out and contact our Business Development Lead, Beth Stillings, to set up time to discuss. bs@dgandl.com

"The Law Court, as it said itself, is moving on from 'casino-by-court'."

To read the full decision, please click the link below.

2024 ME 2 Finch (maine.gov)

Doonan, Graves & Longoria, LLC

Celebrating Native American Heritage Month

- Reneau J. Longoria, Esq.

November 2023

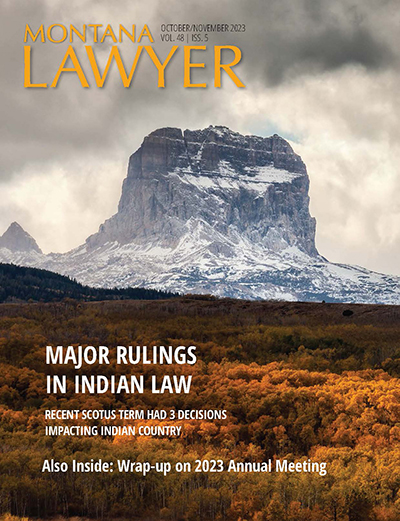

Major Rulings in Indian Law

During each U.S. Supreme Court term, there are always the “must watch” cases. One cannot easily predict the outcome of these cases - certain opinions are in line with precedent, honoring the doctrine of stare decisis, while others carve new paths and shift landscapes. The

2022-2023 term included three cases that both positively and negatively impact tribes across Indian Country.

The U.S. Supreme Court decision in Haaland v. Brackeen surprised many by entirely upholding the constitutionality of the Indian Child Welfare Act and the sovereignty of tribes. The court in Lac du Flambeau Band of Lake Superior Chippewa Indians v. Coughlin diminished tribal sovereign immunity as it pertains to the U.S. Bankruptcy Code. In Arizona v. Navajo Nation, the Supreme Court held that the Navajo Nation could not protect its treaty-based water rights through a breach of trust claim against the federal government.

Attorney Longoria collaborated with Attorney Sara Crawford and Attorney Heather Whiteman Runs Him in an article analyzing these decisions published in recent issue of Montana Lawyer.

To read the full article, please click the link below.

Doonan, Graves & Longoria, LLC

This month we celebrate Indigenous Peoples' Day on October 9, 2023

- Reneau J. Longoria, Esq.

By telling our stories we celebrate all of who we are - this is the beginning of my story . . .

Indian Enough?

The day I read Chairman Gray’s letter putting a stop to those attempting, post-recognition of our Little Shell Tribe by the U.S. Government, to begin to draw lines as to who was and was not “Indian Enough”, my world view changed.

“All Little Shell tribal members belong. We must all follow the Seven Grandfather teachings of Mnaadendimowin – Respect.”

Wise words for all.

Who is Indian enough? My story growing up, and the story of my brothers and sisters — and, more importantly, my father and his brother and sister — was a story of not being Indian enough. Or white enough. Or rich enough.

My grandmother and her sister were removed from their homes to attend “Indian schools” to cleanse them in all of the ways recently highlighted by the historical narrative in the United States Supreme Court’s Concurrence in Haaland v. Brackeen.

The Little Shell Tribe of Chippewa Indians of Montana is a federally-recognized tribe of Ojibwe people in Montana. My father passed in 2008 after The Little Shell Tribe of Montana achieved state recognition but before we were recognized federally on December 20, 2019. There was no prouder moment for our ancestors and descendants than our recognition — except, maybe, when we stood outside the Civic Center in Great Falls, my brother and our children, having received our first Covid vaccination—feeling so grateful for what our Health Director, Molly Wendland, and our tribe, as a whole, accomplished in organizing our first vaccinations. We would feel that pride again looking upon the “Heart” of Little Shell in the new Little Shell Health Clinic. ‘Heart’ of Little Shell (montanafreepress.org)

Our tribe’s federal recognition came at a time when we were on the brink of a worldwide pandemic. Federal recognition gave us the path and the tools, which, along with the time, the respect, the education and, frankly, the resources— we are finally able to move beyond.

Beyond - takes one step at a time.

Beyond - takes courage and a mindset and a desire to learn more; to understand more and, mostly, to listen more. To listen and respect.

My story is the story of my brothers and sisters, our children, grandchildren and, most importantly, our elders. We were fortunate enough to be handed part of our personal story in notebooks printed by Aunt Alice, Aunt Grace, and Uncle Paul, all of whom were dedicated to telling our story in a way that would preserve it. I was given this printed part of our story over 30 years ago and it has remained on my shelf. I have thought from time to time about how to tell the story. My roadblock has always been the feeling that I am not “Indian Enough”. Even as an enrolled member of the Little Shell Tribe, as the fairest skinned of my siblings and having lived most of my adult life “out east” and apart from my people, our people, I had an overwhelming feeling of not being on the inside. Who wants to know the story of a people from the “outside”? The pandemic softened that fear.

During Covid, I had the opportunity to take 42 weeks of Ojibwe in a virtual language class from an amazing woman in our tribe. I took the beginning class - twice. The second time I was joined by my niece, Molly, who has gone on to seek her Masters in Native American Library and Information Science. What an amazing opportunity to begin to learn an ancient language with the next generation. My favorite word is annimouche - dog.

We, my brothers, sisters, our children, our grandchildren and I, have shared parts of this story among us and now, I would like, humbly, to begin to share our story with you. Our story is not in a chronological format —you may find that it is crazy random. It has been inspired by formal learning, informal learning, experiential learning, and spiritual learning. Our story is marked by trials, tribulation, health, sickness, wealth, poverty and challenges none of us planned for but all of us overcame. Most of the time we have “turned chicken shit into chicken salad”, pain and tragedy into glory. Celebration and resiliency are our secret sauce.

If our story is read by only one person, it will have served its purpose and I thank you for taking the time to read. You will see at the end there is no period. Because the story will continue to be told by not only each one of us, but by each one of you. Our hope is that this will begin more conversations as we are all truly

Métis . . .

Miigwech. Thank you.

By telling our stories, we celebrate all of who we are. We celebrate by remembering and sharing - when the time is right for you, please share your story.

Doonan, Graves & Longoria, LLC

You cannot have it both ways:

The Preclusive Impact of a Chapter 7 Discharge on a

Subsequent Challenge to a Mortgage Foreclosure

- Reneau J. Longoria, Esq.

July 2023

You cannot have it both ways

When a Chapter 7 bankruptcy debtor receives a discharge of their debts, they are no longer personally liable for the payment obligations under the Mortgage Loan. Nevertheless, if the debtor plans to stay in the property, then the payments have to be made. On August 10, 2016, Deutsche Bank National Trust Company (“DBNT”) started a judicial foreclosure action to foreclose the Pitassi Mortgage in the Connecticut Superior Court. At first the Pitassis did not initially appear to defend the judicial foreclosure action and, as a result, Default Judgment entered in favor of DBNT. On January 17, 2018, the Pitassis, through Counsel, filed a motion to Vacate and Open Judgment of Default and a Motion to Dismiss for Lack of Subject Matter Jurisdiction, to which DBNT objected. The Connecticut Superior Court subsequently denied the Pitassis’ motion on June 8, 2018. The Pitassis filed multiple appeals that were dismissed by the Connecticut Courts.

The Pitassis originally filed a Chapter 7 Bankruptcy Petition in 2011 and obtained their Chapter 7 discharges. The Pitassis’ initial Chapter 7 Bankruptcy Petition stated that they did not have any potential unliquidated claims other than those at issue in the matter of Kassi v. Chase Bank, which did not involve DBNT’s mortgage loan. On August 10, 2022, Kassiani Pitassi filed a second bankruptcy petition under Chapter 13 of the United States Bankruptcy Code, this time in Maine, however, her proposed plan did not provide for the payment of either of the mortgages on her very valuable, mortgaged premises in Connecticut, which were long in default. Rather, Pitassi raised challenges to DBNT’s standing to enforce the mortgage loan in the non-standard provisions of her proposed plan. Because Pitassi obtained a discharge of her personal liability for the debt owed under DBNT’s mortgage loan based on the representation that she did not have any unliquidated claims related to the same, and Pitassi’s challenges to DBNT’s standing were previously rejected by the Connecticut Courts, the Bankruptcy Court refused to confirm Pitassi’s Chapter 13 plan as a matter of law based on Judicial Estoppel and the Rocker-Feldman Doctrine. See Ribadeneira v. New Balance Athletics, Inc, 65 4th 1, 27 (2023); Rooker v. Fidelity Trust Co., 263 U.S. 413 (1923); District of Columbia Court of Appeals v. Feldman, 460 U.S. 462 (1983).

The Pitassis should be estopped as a matter of law from attempting to collaterally attack the Connecticut Superior Court Judgment in the Bankruptcy Court proceedings because they received the benefit of their Bankruptcy discharge, yet they still sought to challenge the Mortgage lien at issue in this matter as their initial attempts to do so failed in the Connecticut Courts. A debtor cannot have the best of both worlds. Courts should not condone the practice by a debtor of obtaining a Chapter 7 discharge of their personal liability and then remaining in the property or, in this case, collecting rents derived from an investment property, while they continue to challenge the lender’s ability to foreclose the mortgage lien thereon.

“Absent any good explanation, a party shall not be allowed to gain an advantage by litigating on one theory, and then seek an inconsistent advantage by pursuing an incompatible theory.” Ribadeneira v. New Balance Athletics, Inc,

65 F. 4th 1, 27 (1st Cir. 2023)

Doonan, Graves & Longoria, LLC

Responds to the Law Court's Call for an Amicus Brief in Keniston

Arguing Fundamental Principles of Joint Tenancy Control

- Reneau J. Longoria, Esq.

April 2023

Maine Foreclosures: Mortgagee’s Interest in Property is not

affected by the death of a Joint Tenant

On January 17, 2023, the Law Court invited amicus briefs on whether a “debtor” is an indispensable party in a foreclosure when the debtor is deceased, time for probate has passed, and the property is owned by a surviving joint tenant who is not liable on the note. That briefing will be argued Thursday April 6, 2023, in Augusta, Maine.

The Federal vs State conflict in the analysis of necessary parties to a Mortgage Foreclosure and Sale action as set forth in MTGLQ Investors, L.P. v. Alley, 2017 ME 145, 166 A.3d 1002, (“Alley”) in contrast with the U.S. District Court’s decision in Johnson-Toothaker v. Bayview Loan Servicing LLC, Civil Action No. 20-CV-00371-JDL, 2022 WL 3278883 (2022)(“Toothaker”) is the heart of the controversy. The Alley Court reversed the Trial Court Foreclosure Judgment in favor of MTGLQ, sua sponte, and ordered that the complaint be dismissed without prejudice where it named neither the (deceased) debtor nor the debtor’s estate. In Toothaker, the District Court reasoned that because Maine is a title theory state, a mortgage is enforceable even if the note is not, and, it follows that the deceased debtor or his/her estate are not necessary parties to a foreclosure.

DGL submitted the attached Amicus brief taking the position that the Alley decision was incorrect, the correct parties were named and no more was required given the fact that one of the two joint tenants survived and was named in the foreclosure action. The Plaintiff did not advance a claim on the Keniston Note and made it clear only an in rem judgment extinguishing the remaining joint tenant’s interest in the property was sought. There was no “missing party;” in fact, given the status of the joint tenancy, the naming of the heirs was superfluous and, as a result, the matter should not have been dismissed. In a title theory state such as Maine, naming the remaining joint tenant is all that is necessary to foreclose the mortgage lien. The mortgagee’s interest in the property was not impacted by the death of one of two joint tenants and no formal administration of the deceased tenant was required to foreclose the right of redemption and enforce its mortgage lien.

We advocated for adherence to the fundamental principles of Joint Tenancy in a Title Theory State: A mortgagee’s interest in property is not impacted by the death of one of two joint tenants and no formal administration of the estate of a deceased joint tenant is required to foreclose a right of redemption and enforce a mortgage lien.

Doonan, Graves & Longoria, LLC

Overcomes Defendant’s Attempt to Invoke the Rooker-Feldman Doctrine

to avoid a Federal Claim for Possession

- Brian C. Linehan, Esq.

February 2023

Court Thwarts Borrower’s Attempt to use Rooker-Feldman Doctrine to dismiss Federal Possession/Eviction Case in the

District of Massachusetts

Following a thorough, clear analysis of the history and application of the Rooker Feldman Doctrine, the Federal Court rejected the Defendants’ attempt to avoid our client’s claims.

The Court explained that "the Rooker-Feldman doctrine is narrow, prohibiting only de facto appeals of state court judgments, and distinct from the law of issue and claim preclusion. . . the critical datum is whether the plaintiff’s federal suit is, in effect, an end-run around a final state-court judgment . . . Rooker-Feldman is not simply preclusion by another name."

At bottom, Schreffler has repackaged her res judicata argument in the wrappings of the Rooker-Feldman doctrine. Because Stonecrest is not ‘seeking to have this court reject the two previous state court judgments,’ the Rooker-Feldman doctrine simply does not apply.

Doonan, Graves & Longoria, LLC

Responds to the Law Court's Call for an Amicus Brief

in Moulton Arguing for the Reversal of Deschaine and Pushard

- Reneau J. Longoria, Esq.

September 29, 2022

MAINE FORECLOSURES:

Is it time for a return to pre-2014 jurisprudence?

“On August 23, 2022, [The Law Court] signaled it may be time to reconsider the breadth and depth of the Deschaine and Pushard Decisions and to provide clarity both on what this Court intended in those decisions, and whether Deschaine and its progeny were consistent with Maine law prior to 2017 when decided.” [AB 5]

“In short, a residential, judicial foreclosure in a title theory state is, by statute, an action in equity designed only to remove the equitable right of redemption and should never have preclusive effect on subsequent foreclosures.” [AB 15]

“Like this Court’s decision in The Bank of New York Mellon v. Shone, 2020 ME 122, 238 A.3d 671, this case presents an opportunity to resolve the conflict between the Deschaine and Pushard precedent and prior decisions grounded in Maine title theory, See U.S. Bank Nat’l Ass’n v. Gordon, 2020 ME 33, ¶¶ 15-30, 227A.3d 577 (Horton, J., concurring) (outlining the recent departure from precedent dating back to the nineteenth century).” [AB 7]

We will keep you informed of the decision. Please reach out to schedule in-person or virtual DGL Knowledge Exchanges to discuss strategies on your particular cases during these changing times.

We think the time was right to respectfully advocate for a change in the law in the hopes of returning Maine to its roots in title theory. We filed our Amicus Brief with that in mind.

Doonan, Graves & Longoria, LLC

Obtains Favorable Decision from the U.S. District Court Confirming that Defects in a Contractual Notice of Default do not Affect Foreclosure by Entry

- Brian C. Linehan, Esq.

August 2022

FORECLOSURE BY ENTRY

Physical entry on the property, recordation of a Certificate of Entry and expiration of three year-redemption period = the third, independent path to foreclosure in Massachusetts

A defective contractual notice of default does not affect the validity of a foreclosure by entry.

In Emigrant Mortgage Company, Inc. v. Bourke, 2022 WL 3566832, --- F.Supp.3d --- (D.Mass. Aug. 18, 2022)(“Bourke II”), the U.S. District Court reviewed the potential effect that a defective contractual notice of default may have on a mortgagee’s foreclosure by entry and possession under G.L. c. 244, § 1. Following a failed summary process action for possession, which was dismissed on appeal as a result of defects in the mortgagee’s contractual notice of default that rendered the mortgagee’s foreclosure by exercise of the statutory power of sale void, see Retained Realty, Inc. v. Bourke, 2019 Mass.App.Div. 183, at *2-3, the foreclosure sale purchaser brought a subsequent action in the U.S. District Court seeking to recover possession of the foreclosed premises based upon the mortgagee’s foreclosure by entry and possession. Bourke II, 2022 WL 3566832, at *2. Unlike a foreclosure by exercise of the statutory power of sale, which is a remedy that is incorporated into the terms of the mortgage contract, a foreclosure by entry and possession is purely statutory. Cf. id. at * 4-5. Accordingly, the U.S. District Court determined that compliance with the terms of the mortgage – specifically the contractual notice requirement found in paragraph 22 – is not required to affect a valid foreclosure by entry and possession under G.L. c. 244, § 1. See id. at *5.”

A link to an article in Massachusetts Lawyers Weekly about this matter has been linked below:

https://masslawyersweekly.com/2022/08/26/mortgages-res-judicata-foreclosure-by-entry/

“Foreclosure by entry . . . does not require the mortgagee to send a notice pursuant to ¶ 22 [of the mortgage contract] before making an entry for possession... The Defect in the notice of default sent by Emigrant is thus irrelevant to the question of whether the plaintiffs may proceed with foreclosure by entry.”

Judge Gorton

Doonan, Graves & Longoria, LLC

Announces New Managing Member, Reneau J. Longoria, Esq.

- Reneau J. Longoria, Esq.

January 2022

Doonan, Graves & Longoria, LLC (“DG&L”) is proud to announce that

Reneau J. Longoria, Esq. has assumed responsibilities as Managing Member, effective October 15, 2021. Attorney Longoria previously managed the practice areas of Foreclosure, Litigation, and Bankruptcy. As the Managing Member, she will continue to serve and support the attorneys and staff in the firm’s default, appellate and general practice in Massachusetts, Maine and New Hampshire, as well as assuming duties in the management of the business.

Attorney Longoria’s dedication and energy has remained consistent from her first eight years in criminal practice wherein she held positions with the Department of Justice, United States Attorney’s Offices in Texas and Washington, the Rockland County District Attorney’s Office in New York and the Attorney General’s Office in Texas. Attorney Longoria is barred in Massachusetts, Maine, New York, New Hampshire, Texas, Montana, the U.S. District Courts in Maine and Massachusetts, as well as the First, Second and Fifth Circuit Courts of Appeals and the U.S. Supreme Court. Attorney Longoria joined the firm in 1996 and became a Member in 2001.

Attorney Longoria states that she is “passionate about leading the firm forward as we build on our success and continue to strive for ‘Excellence. Daily.’ in these changing times.” Attorney Longoria explained, “the Pandemic presented many challenges to businesses world-wide and the Default Industry in particular.”

“Our dedication to overcoming those challenges through innovation, resiliency and personal sacrifice, while protecting the health and safety of our staff and clients, demonstrates that, together, we have the strength for the next chapter in the firm’s history.” “I believe our next chapter will be our best chapter yet and I plan to lead this firm forward from the Pandemic healthier mentally, physically and financially.” “As a result of DG&L’s ability to adapt to the changes in the industry during the Pandemic, DG&L has, and will continue to distinguish itself, and provide our clients with exceptional legal service.”

“Reneau is held in the highest regard by both the Bar and the Bench where she is a supremely effective advocate for our clients. There is no doubt in my mind or soul that the firm’s future is in

excellent hands for many years to come.”

John A. Doonan

Copyright 2022

Website by AB Web Centers